Ownership in a company ultimately comes down to who holds the shares. For companies registered in the British Virgin Islands (BVI), this ownership is represented by a single, tangible piece of evidence—the BVI share certificate. Whether you’re opening a bank account, onboarding with a fintech platform, or transferring shares to a new owner, this certificate often becomes the first point of validation.

It’s more than just a document. It’s your stake in the company—and your proof of it.

This blog post will delve into everything you need to know about the BVI share certificate, from its legal basis and essential contents to its issuance, importance in share transfers, and even what to do if it’s lost.

Table of Contents

What Is a BVI Share Certificate?

A BVI share certificate is an official document issued by a company incorporated in the British Virgin Islands. It confirms that a person or entity legally owns a specified number of shares in that company. This certificate is governed under the BVI Business Companies Act, 2004.

It serves as:

- Evidence of ownership for shareholders

- A legal record that supports corporate transactions and share transfers

- A document accepted by banks, regulators, and courts

These certificates may be issued physically (as printed paper documents) or digitally, depending on the company’s preference.

Just as a birth certificate proves your identity and citizenship, a BVI share certificate proves your ownership rights and entitlements within the company structure. Without a share certificate, proving ownership becomes difficult—especially in legal or financial disputes.

When and Why Is a Share Certificate Issued?

A BVI company share certificate is typically issued at key junctures in a company’s lifecycle or a shareholder’s journey:

- Initial Allotment: When a company first issues shares, either during its incorporation process or through a subsequent allotment.

- Share Transfers: After a change in ownership, where shares are transferred from one party to another.

- Redemptions or Re-issues: If shares are redeemed by the company, or if a certificate needs to be re-issued due to loss or damage.

The certificate is often required for:

- Opening Corporate Bank Accounts: Many banks, especially in traditional financial centers, still request a BVI share certificate as part of their due diligence for new account openings.

- Raising Capital: Investors and venture capitalists may ask for sight of share certificates to confirm the legal ownership structure before investing.

- Due Diligence Processes: In mergers, acquisitions, or significant partnerships, the share certificate provides clear evidence of who controls the shares.

- Internal Corporate Records: For companies and their shareholders, it’s a vital part of comprehensive record-keeping.

- Shareholder Disputes or Succession Planning: In the event of disagreements or for estate planning, the certificate provides clear documentation of ownership.

What Information Is Contained in a BVI Company Share Certificate?

A properly formatted share certificate for a BVI company contains specific information mandated by law and best practices. Missing any crucial element can render the certificate invalid or problematic for future transactions. A share certificate for BVI companies typically includes:

Company Identification:

- Full legal company name as registered in BVI

- BVI company registration number

- Date and place of incorporation

Certificate Details:

- Unique certificate number for tracking

- Date of certificate issuance

- Class of shares (ordinary, preference, etc.)

Shareholder Information:

- Full legal name of the shareholder

- Complete address of the shareholder

- Nationality and identification details (when required)

Share Particulars:

- Total number of shares certificated

- Par value per share (if applicable)

- Share class and any special rights

- Certificate serial number for security

Authorization:

- Names and signatures of issuing directors

- Date of authorization

- Company seal (when required by articles)

Legal Disclaimers:

- Reference to company’s articles of association

- Transfer restrictions (if any)

- Rights and obligations statements

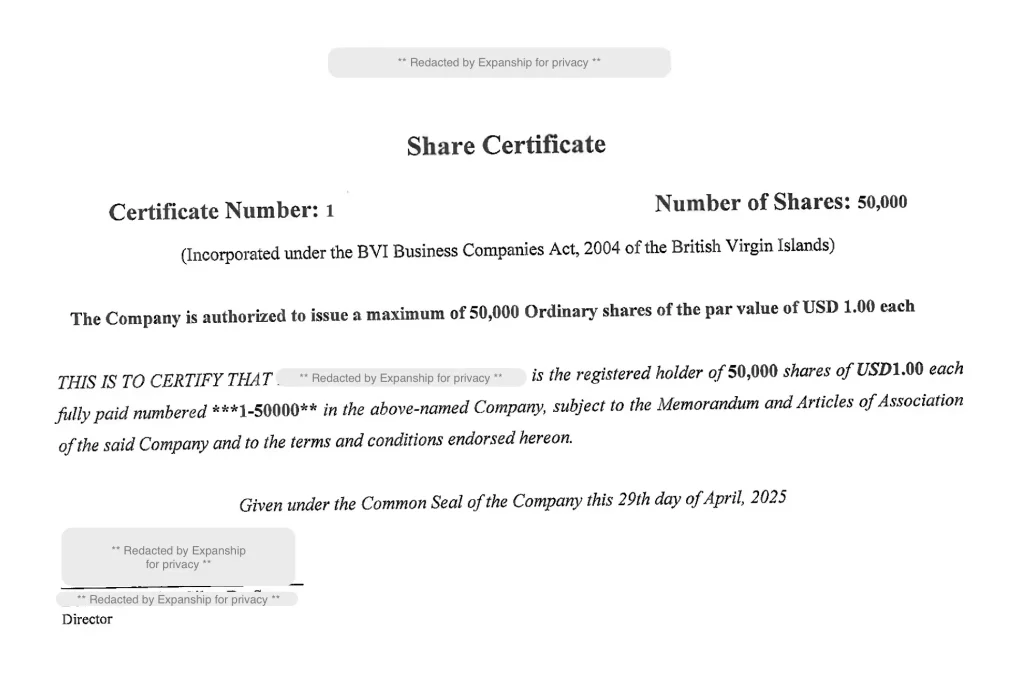

Sample BVI Share Certificate

While there is no single legally mandated BVI share certificate prescribed by law, most Registered Agents and corporate service providers use standard templates that are compliant with the BVI Business Companies Act.

Unlike jurisdictions that mandate a strict share certificate format, the BVI allows flexibility. However, we advise following best practices such as assigning certificate numbers, including par value, and referencing the Register of Members for full alignment.

Directors typically sign and issue the certificate based on a board resolution, confirming the allotment or transfer of shares. While you can customize a share certificate with your company’s logo or specific design elements, always ensure it complies with your company’s Memorandum and Articles of Association (M&A) and BVI law. For added security and to prevent fraud, including unique certificate numbers and potentially watermarks is a good practice.

Is It Mandatory to Issue a Share Certificate in the BVI?

This is a common question, and the answer offers flexibility under BVI law. Unlike some older jurisdictions, the BVI Business Companies Act, 2004, does not legally mandate the issuance of physical share certificates. BVI companies can, by their Articles of Association or director resolution, opt for “uncertificated shares,” where ownership is solely recorded in the company’s Register of Members.

However, despite this legal flexibility, issuing a BVI share certificate is highly recommended in most cases.

Regardless of whether certificates are issued, directors are legally obligated to maintain an accurate and up-to-date Register of Members, as this remains the definitive legal record of share ownership in a BVI company.

How to Issue a Share Certificate?

Issuing a BVI share certificate involves a straightforward process:

- Check M&A: Confirm if the company’s Memorandum and Articles require certificate issuance.

- Board Approval: Obtain a board resolution to issue shares and certificates.

- Draft Certificate: Use a BVI share certificate template or hire a professional to prepare one.

- Include Details: Ensure all required information (e.g., shareholder name, share count) is accurate.

- Sign and Seal: Have the certificate signed by a director or authorized agent; apply a company seal if needed.

- Update Records: Record the issuance in the company’s Register of Members.

- Deliver: Provide the certificate to the shareholder (physical or digital).

Who Issues and Signs the Share Certificate?

A share certificate is typically issued by the company itself, acting through a BVI company’s authorized officers:

Registered Agent’s Role: While the directors hold the authority, the company’s Registered Agent often plays a crucial role in assisting with the preparation, proper execution, and dispatch of share certificates, ensuring they meet all legal requirements.

Issuing Authority: The power to issue shares and certificates usually lies with the company’s directors, as outlined in the company’s Memorandum and Articles of Association.

Signing: The certificate must be signed by one or two directors, or by the company secretary, depending on the specific provisions in the company’s Articles of Association.

Digital vs. Physical Share Certificates

Modern technology has transformed how BVI share certificates can be issued and maintained, offering both digital and physical options. At Expanship, we’ve handled hundreds of BVI share certificate issuances—both digital and physical—especially for clients needing bank onboarding or investor presentations.

| Feature | Physical Certificate | Digital Certificate |

| Legality | Accepted globally | Equally valid if properly signed |

| Bank Requirements | Often preferred | Some banks accept digital copies |

| Security | Risk of loss/damage | Secure with e-signatures |

| Convenience | Slower to transfer | Instant delivery |

Replacing a Lost or Damaged Share Certificate

If a BVI share certificate is lost or damaged, follow these steps to reissue:

- Notify the Company: Inform the directors or registered agent immediately.

- Provide Indemnity: Submit a letter of indemnity to protect the company against potential fraud.

- Board Resolution: Obtain approval to reissue the certificate.

- Update Records: Ensure the Register of Members reflects the reissuance.

- Issue New Certificate: Draft and deliver a new certificate with a unique number.

To prevent fraud, companies may add security measures like notations on the new certificate.

Share Transfers and the Role of the Share Certificate

The BVI share certificate plays a key role in share transfers:

- Proof of Ownership: The certificate is surrendered to confirm the transferor’s legal ownership.

- Cancellation: The original certificate is canceled upon transfer.

- New Issuance: A new BVI company share certificate is issued to the transferee.

- Record Update: The transfer is recorded in the Register of Members.

This process ensures legal clarity and compliance during ownership changes.

Frequently Asked Questions (FAQs)

-

Is a BVI share certificate mandatory?

No, but strongly recommended for evidentiary and compliance reasons.

-

Can I issue digital share certificates?

Yes, as long as they are properly signed and meet your M&A requirements.

-

How do I verify if a certificate is valid?

Cross-check with the Register of Members or request verification via your registered agent.

-

What happens if I lose my certificate?

Request a replacement by providing indemnity and updating company records.

-

What’s the difference between a share certificate and the Register of Members?

A share certificate proves ownership. The register is the official company record of all members.

-

Can share certificates be issued in different currencies?

Yes, BVI companies can issue shares with par values in various currencies, though USD is most common.

Conclusion

A BVI share certificate isn’t just a procedural formality—it’s a powerful document that evidences your ownership in a BVI company. Whether you’re managing internal records, raising capital, or engaging with banks, having clear, compliant certificates makes every step smoother. Work with a reliable registered agent like Expanship to issue, format, and maintain accurate share certificates for your BVI company.